Disability. When most of us hear the term, we picture someone injured in an accident. But the reality is far different: Multiple sclerosis. Parkinson’s. Anxiety. Musculoskeletal issues. Heart conditions. Back disorders. These are some of the leading causes of disability. They can strike any of us at any time. In fact, according to the Council on Disability Awareness before age 65 the risk is more than 30% greater than the risk of death.

An employer-provided group long-term disability or LTD plan is a great foundation and, in our opinion, one of the best benefit dollars to spend.

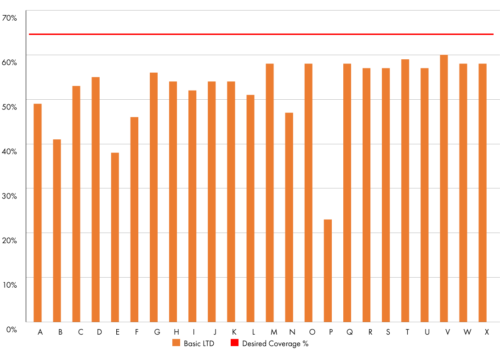

But group LTD was never intended to serve the needs of your highest-paid people who are often driving the most value for your organization. Group LTD formulas always have a cap on the benefit amount and rarely cover anything other than base salary.

Tweet

Tweet Share

Share Email

Email